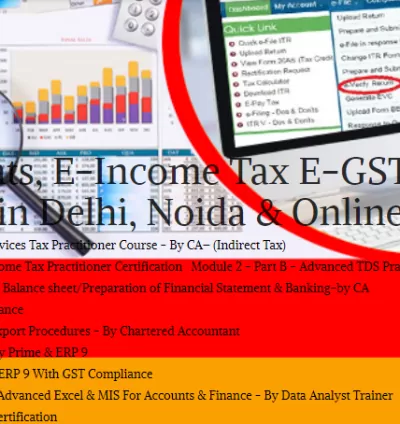

Here is a step-by-step guide to filing GSTR-1, GSTR-2, and GSTR-3B, along with information on a practical GST course in Delhi 110004 by SLA Consultants India:

How to File GSTR-1 (Outward Supplies Return)

-

Login to the GST portal using your GSTIN, username, and password.

-

Navigate to Services > Returns > Returns Dashboard.

-

Select the financial year and month/quarter for filing.

-

Click on GSTR-1 to open the form.

-

Enter details invoice-wise for outward supplies including:

-

Sales to registered and unregistered taxpayers.

-

Exports.

-

Advances received.

-

Debit/Credit notes.

-

-

Verify auto-populated details and upload invoices or use the offline utility to prepare data.

-

Preview the form to check errors.

-

Submit the form and then file with DSC (Digital Signature Certificate) or EVC.

-

Download the acknowledgment after successful filing.

-

NIL return filing option is available if no outward supplies were made.

GSTR-2 (Inward Supplies Return) — Currently Suspended

-

GSTR-2 is not filed by taxpayers since its suspension in 2017.

-

Instead, use GSTR-2A and GSTR-2B auto-populated purchase data from the GST portal to reconcile your input tax credit claims against purchases.

-

No direct filing steps exist for GSTR-2, but you reconcile inward supplies by verifying GSTR-2A/2B data with your purchase records.

How to File GSTR-3B (Summary Return & Tax Payment)

-

Login to the GST portal with your credentials.

-

Go to Services > Returns > Returns Dashboard.

-

Select the correct financial year and month.

-

Click on GSTR-3B for the selected period.

-

Enter summary details such as:

-

-

Outward supplies and inward supplies liable to reverse charge.

-

Interstate supplies made to unregistered persons, composition scheme taxpayers, and UIN holders.

-

Input Tax Credit (ITC) claimed, reversed, or ineligible.

-

Details of exempt, NIL, and non-GST supplies.

-

-

The portal auto-populates some data based on GSTR-1 and GSTR-2B but can be edited.

-

Enter any interest or late fee payable if filed after due dates.

-

Click Save frequently to avoid loss of data.

-

After completing all necessary sections, preview the return.

-

Submit the GSTR-3B and file it using DSC or EVC.

-

Make the payment of outstanding GST liability through the payment module.

Practical GST Certification in Delhi 110004 by SLA Consultants India

-

SLA Consultants India offers a hands-on practical GST training focusing on real-world filing of GSTR-1, GSTR-3B, and ITC reconciliation using GSTR-2A/2B.

-

The course includes live GST portal demonstrations, troubleshooting common filing errors, and guidance on legal and procedural compliance.

-

It suits professionals, CA students, and business owners aiming to confidently manage GST returns.

-

Available in flexible batches with online and offline options, located in Delhi NCR (area 110004).

This guide ensures smooth filing and compliance with GST rules while the practical GST course by SLA Consultants India can further enhance your efficiency in managing GST returns professionally.

SLA Consultants How to File GSTR-1, GSTR-2, and GSTR-3B: Step-by-Step Guide, Get Practical GST Course in Delhi, 110004, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: [email protected]

Website: https://www.slaconsultantsindia.com/

| Shipping Cost |

|

| Product Location | 82-83, 3rd Floor, Vijay Block, Above Titan Eye Shop, Metro Pillar No. 52,Laxmi Nagar, New Delhi,110092, 82-83, 3rd Floor, Vijay Block, Above Titan Eye Shop, 110092, Delhi, India |

No reviews found!

English

English Việt Nam

Việt Nam

No comments found for this product. Be the first to comment!